The Ultimate Anguish of the Bear Market Blues

6 HOT TIPS FOR TRADING IN A BEAR MARKET

Financial markets go through many cycles of trending and ranging conditions. When the markets are trending up, trading can seem easy. You throw a dart at the board and making money almost seems like magic. When the market turns and starts to trend down, your profits will disappear and you’re going to find it extremely hard to make money spot trading. If the market starts to range, you run the risk of getting trapped into positions for a long period of time. Here are six hot tips to help you beat the bear market blues!

1. Avoid Directional Bias

Directional bias is when you tend to look at the market subjectively to suit what you would like to happen and ignore other signs. People are wired to have a bullish directional bias and will often fall in love with their “bags”. It can take time to condition yourself to lose this connection and treat the market as a money-making machine. Just because you like Ethereum, doesn’t mean you can’t trade it down if it looks bearish, you won’t hurt its feelings! I like to look at the market in a binary way – it’s all just 1’s and 0’s. I don’t like one pair any more than another, I’m just looking for the pair that will make me money even in the bear market!

2. Use Leverage

Despite what the Facebook gurus will tell you, leverage is not the devil. There are certainly cases of people over leveraging and liquidating themselves, but that is either from a lack of education or because they were simply gambling. If you are using correct risk management and position sizing, then you maximise your chances of being successful. VEMA Trader even does this for you automatically. Not only does it allow you to reduce your exposure by deploying less capital in the bear market, it also allows you to hedge positions and make money from shorting the market. This is a must during a bearish cycle. The markets being on a downward trend does not mean you have to go without profit!

3. Trade Volatility

Most traders are taught how to trade with the trend. There is nothing wrong with that, but if the market drops in volume and starts to range, you lose your edge very quickly. This can either cause you to lose lots of trades from false signals, or simply bench you from not finding any trending opportunities to trade. Sometimes the best strategies to use during a ranging market are the simplest ones. Always look for the support and resistance, the supply and demand. It is always there, even in the bear market. Find a range and trade the volatility!

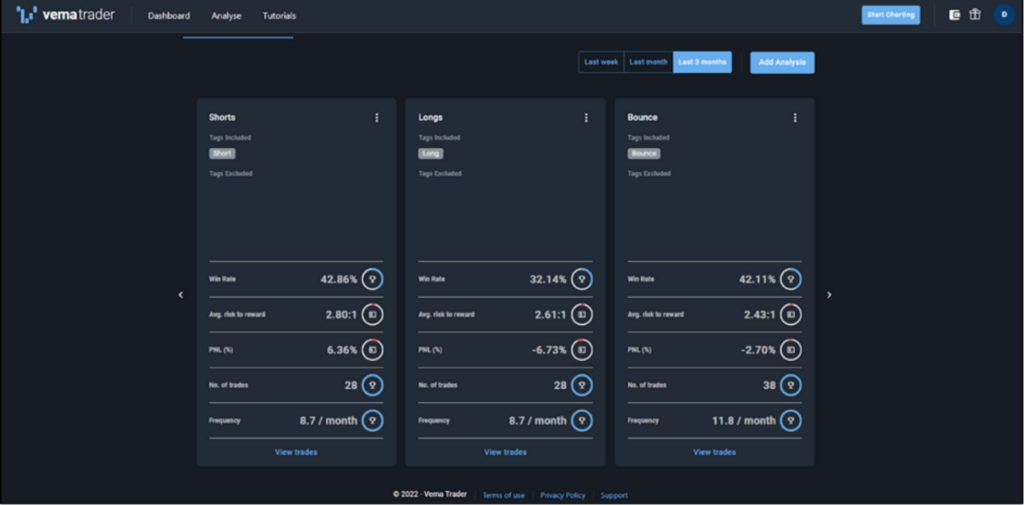

4. Analyse Your Data

Now is the perfect time to jump into your trading data and see exactly how you have been performing. VEMA Trader makes this super easy with its intuitive analysis dashboard and the ability to tag your trades to calculate your statistics and performance. You can create different card combinations to find which strategies are working best for you and which ones may need some tweaking.

5. Practice, Practice, Practice…On Paper!

Who says you need to stop trading? If you’re not confident trading in the current market, then switch over to paper trading and try a few new strategies. Create some new analysis cards and track your performance. The more you practice, the better you will get. Paper trading gives you the chance to see if you can come up with a winning combo that you can use when the next bear market hits. With VEMA Trader, the trade setup experience for paper trading is identical to live trading and you can share your setups and outcomes in our community Discord. Here you can share your thinking, get feedback and see how others make it work.

6. Upskill

If you’re not confident trading these conditions, then use the current cycle to brush up your skills. Remember that you are not alone in the world of trading. Trading education with companies like MBA Trading Academy give you the opportunity to participate in self-paced courses and tutorials as well as connect with trading professionals. They have several professional, and verified trading educators, that host weekly lessons and market scans and are eager to see you succeed. You might learn some new strategies or get back to the roots of reinforcing good habits that make you a successful trader.

Trading is a long-term commitment. Don’t expect to make enormous profits straight away. In fact, most of the professional traders I know have taken years to get to full time trading status. You have to experience a few ups and downs in the markets to really find your edge in all conditions. Don’t feel you will miss out on that one trade that is going to change your life. There will be hundreds, if not thousands of those in your trading career. Sticking to a trade plan, being disciplined, implementing strict risk management and the consistency of doing a little bit each day will see you reach your goals. With VEMA Trader, you will find it comes easier than ever before.