Protecting Your Trades in Fast Markets!

People underestimate the Impact Slippage Can Have on Their Trades

We’re tackling a critical issue that many day traders tend to overlook or underestimate: slippage. Although it might appear to be a minor inconvenience, slippage can have a substantial impact on your trades, particularly when you’re working with short timeframes.

What is Slippage?

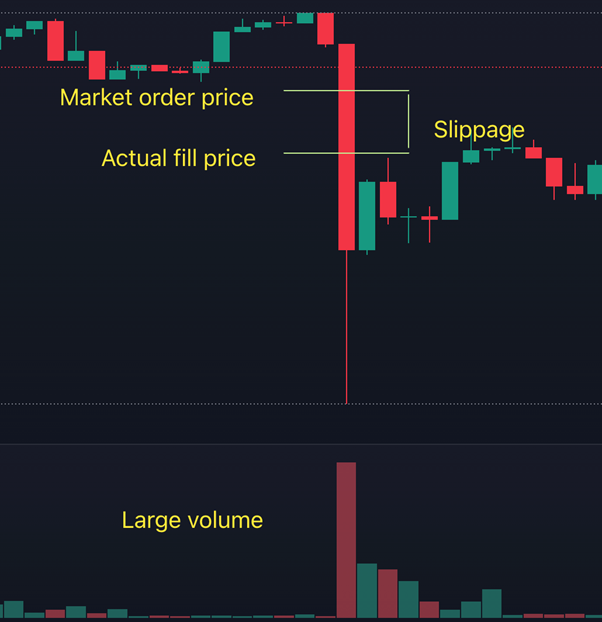

At its core, slippage is the difference between the expected price of a trade and the actual price at which it gets executed. This discrepancy occurs because the market moves so quickly that the price can change from the moment you place your order to the moment it gets filled.

Imagine you plan to enter a short position at $12,070 with a stop loss set at $12,078. You expect that if your stop loss is hit, your position will close at $12,078. However, due to a sudden spike in trading volume, your stop loss might not get filled at $12,078 but rather at $12,090. This $12 difference might not seem like much, but in the world of scalping, it can make or break a trade.

Slippage – Not Just a Minor Inconvenience

Slippage is more than just an annoying aspect of trading; it can have substantial consequences. When you’re scalping, even a slight deviation from your expected entry or exit price can turn a winning trade into a losing one. For instance, in our previous example, the slippage increased the loss from what was planned, effectively tripling it. If you had planned to risk 1% of your margin, slippage could easily make that a 3% loss instead.

Consequence of Slippage is…

The immediate consequence of slippage is financial loss. However, the impact extends beyond your trading account. Frequent and significant slippage can lead to overtrading as you try to recover losses. This overtrading can cause emotional and psychological stress, leading to poor decision-making and further losses. Moreover, the anxiety and frustration from these unexpected outcomes can spill over into your personal life, affecting your relationships and overall well-being.

So Next Time…

Before you place a trade, especially in scalping, consider the potential impact of slippage. Use tools and strategies to mitigate its effects, such as setting more conservative stop losses. Always account for the possibility of slippage in your risk management plan.

Want to Learn More…

Now that we know what slippage is, next blog we will look at why slippage occurs. We’re here to help you navigate the complexities of scalping. Keep an eye out here! We will be posting more about this topic each week, diving deeper into the nuances of scalping and providing you with the tools and knowledge to succeed. Stay tuned and happy trading! 🚀📈