Tagging Trades for Improved Analysis

In our last blog we discussed the first stage of the journaling process in VEMA Trader – the ‘Notes’ feature. The Tagging feature completes the journaling process, and it is this feature that will take reviewing your trades to a whole new level!

VEMA Trader gathers information on every trade by utilising both automatic and user generated tags. These tags simplify the journaling process and allow for extensive data analysis.

There are automatic tags collected by VEMA Trader when you set up your trade. These tags identify things such as the asset traded, direction, strategy, timeframe, entry conditions, confidence level, mood, exchange used, risk to reward ratio and stop loss type.

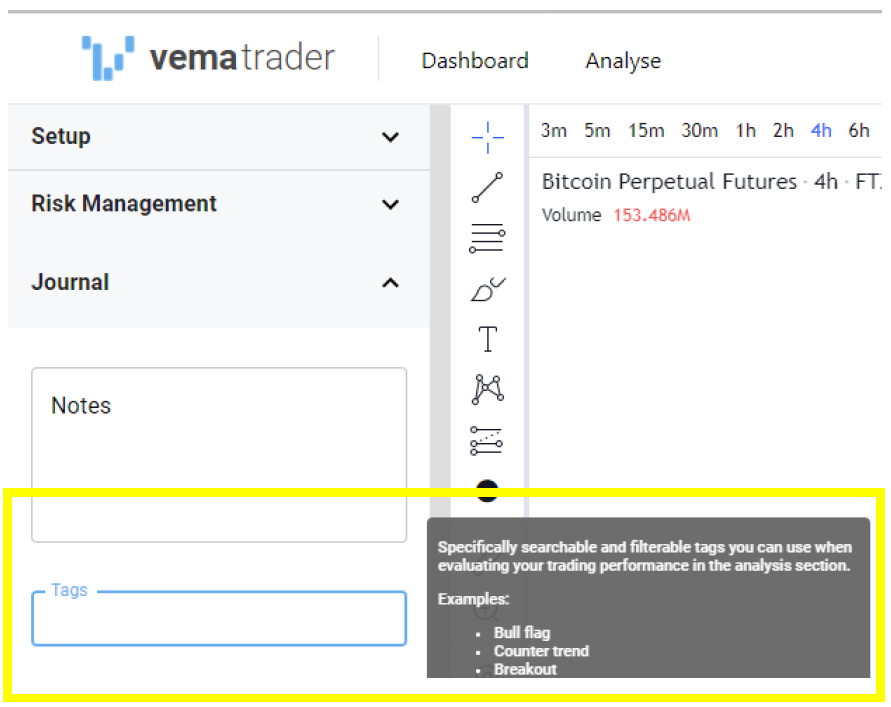

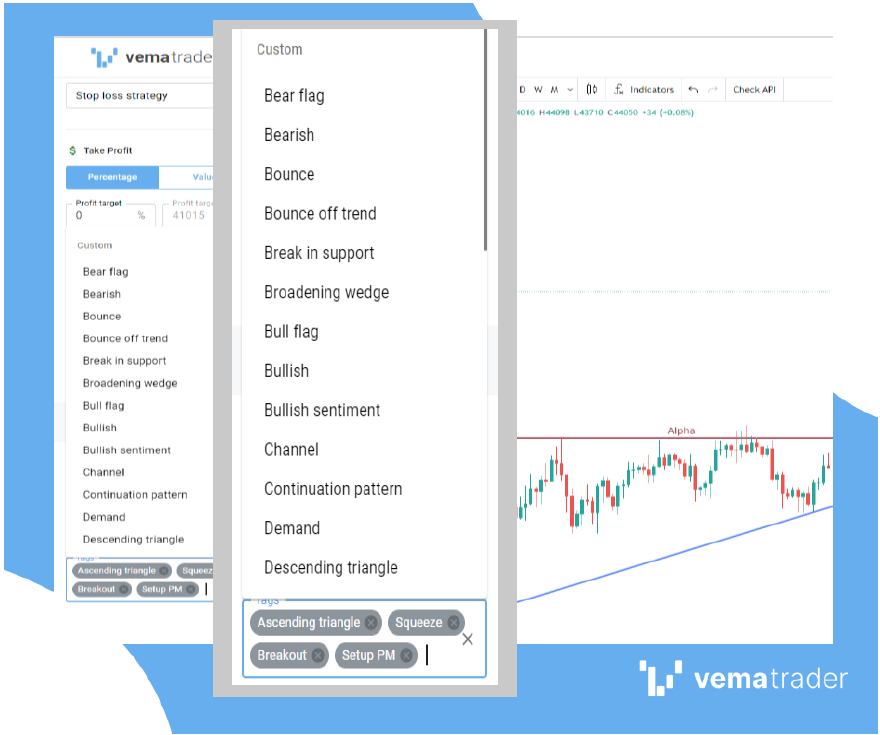

In addition to the automatic tags, you can add as many custom tags as you wish, and it is strongly recommended that you take advantage of this feature. The purpose of custom tags is to include any information not automatically tagged that you would like to use when filtering your closed trades.

Analysis Cards

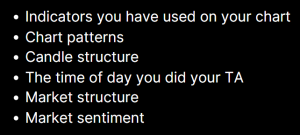

The more you use the custom tags feature, the more in depth your analysis will be. Try to think of all the ways you want to be able to filter and compare your trades to look for patterns – it could be things such as:

Each time you add a custom tag, it will automatically be saved to your Tags list for future trades. You can interact with this feature here.

Fine-tune your trade analysis further by adding or removing tags post-trade. Capturing changing market conditions or thoughts later in the trade lifecycle can offer a much more comprehensive data analysis.

Both the automatic and custom tags come into play VEMA’s Analyse feature. This is where you can filter tags and generate Analysis cards to find patterns, review your trading performance, and look for areas where there is room for improvement. This

This intuitive tagging system is one of the many ways you can improve your trading performance and psychology with VEMA Trader.

By Sam Sillett